A Predetermined Overhead Application Rate

Formula to Calculate Predetermined Overhead Rate

A Predetermined Overhead rate Predetermined overhead rate is the distribution of expected manufacturing price to the presumed units of car-hours, direct labour hours, directly fabric, etc., for acquiring the per-unit of measurement expense before every accounting period. read more shall be used to calculate an estimate on the projects that are yet to commence for overhead costs. It would involve calculating a known cost (like Labor cost) and then applying an overhead charge per unit (which was predetermined) to this to project an unknown cost (which is the overhead corporeality). The formula for computing Predetermined Overhead Rate is represented as follows.

Predetermined Overhead Rate = Estimated Manufacturing O/H Price / Estimated total Base Units

You are free to use this paradigm on your website, templates, etc, Please provide us with an attribution link Commodity Link to be Hyperlinked

For eg:

Source: Predetermined Overhead Rate Formula (wallstreetmojo.com)

Where,

- O/H is overhead

- Total base units could be the number of units or labor hours etc.

Tabular array of contents

- Formula to Calculate Predetermined Overhead Charge per unit

- Predetermined Overhead Rate Calculation (Step by Step)

- Examples

- Example #1

- Example #two

- Case #3

- Relevance and Uses

- Recommended Articles

Predetermined Overhead Rate Calculation (Step past Step)

The predetermined overhead rate equation can exist calculated using the below steps:

- Gather total overhead variables and the full amount spent on the same.

- Find out a relationship of cost with the allocation base, which could exist labor hours or units, and further, information technology should be continuous.

- Determine ane allocation base for the department in question.

- Now accept a total of overhead cost and so divide the same by the allotment base of operations determined in step three.

- The rate computed in step four can too exist practical to other products or departments.

Examples

Example #1

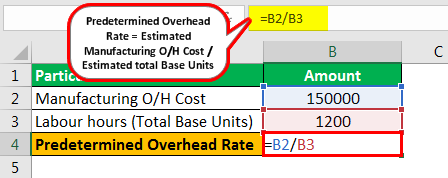

Suppose that X limited produces a product 10 and uses labor hours to assign the manufacturing overhead cost. The estimated manufacturing overhead was $155,000, and the estimated labor hours involved were 1,200 hours. You are required to compute a predetermined overhead charge per unit.

Solution

Here the labor hours will be base units.

Utilise the following data for the calculation of a predetermined overhead rate.

- Manufacturing O/H Price: 150000

- Labor hours (Full Base Unit of measurement): 1200

Calculation of the predetermined overhead rate can exist done as follows:

=150000/1200

The predetermined Overhead Rate will be –

Predetermined Overhead Rate = 125 per directly labor 60 minutes

Instance #2

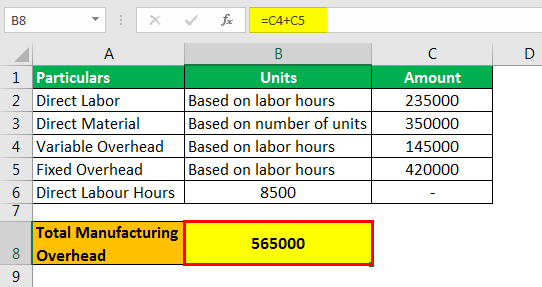

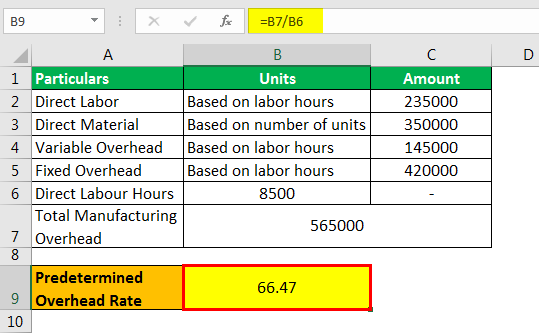

Gambier is caput of TVS Inc. He is considering the launch of the new production, VXM. Nevertheless, he wants to consider the pricing for the same. Therefore, he has asked the product head to develop the details of costing based on existing product overhead costs to apply the same to product VXM while making its pricing decisions. The details from the production department are every bit follows:

| Item | Units | Corporeality |

|---|---|---|

| Straight Labor | Based on labor hours | 235000 |

| Straight Material | Based on the number of units | 350000 |

| Variable Overhead | Based on labor hours | 145000 |

| Stock-still Overhead | Based on labor hours | 420000 |

| Directly Labor Hours | 8500 | – |

The production caput wants to summate a predetermined overhead rate, as that is the main cost allocated to the new production VXM. Therefore, you are required to calculate the predetermined overhead rate.

As the production caput wants to calculate the predetermined overhead rate, all the direct costs will be ignored, whether directly cost Directly cost refers to the cost of operating core business organization activity—production costs, raw material cost, and wages paid to manufacturing plant staff. Such costs tin can be determined by identifying the expenditure on cost objects. read more (labor or fabric).

Solution

Calculation of Total Manufacturing Overhead

The total manufacturing overhead Manufacturing Overhead is the total of all the indirect costs involved in manufacturing a product like Belongings Tax on the production premise, Remunerations of maintenance personnel, Rent of the manufacturing building, etc. read more toll volition be variable overhead, and fixed overhead, which is the sum of 145,000 + 420,000 equals 565,000 total manufacturing overhead.

=145000+420000

Full Manufacturing Overhead = 565000

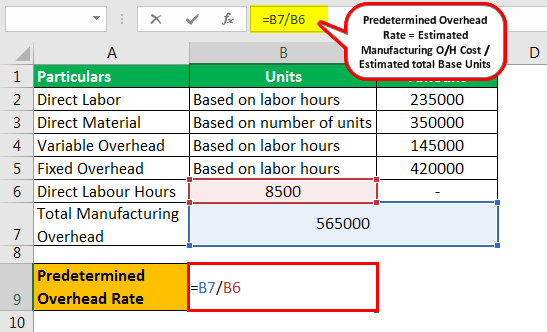

Here the labor hours will be base units

Adding of the predetermined overhead charge per unit tin be done as follows:

=565000/8500

The predetermined Overhead Rate will be –

= 66.47 per direct labor hour

Hence, this predetermined overhead rate of 66.47 shall be applied to the pricing of the new product VXM.

Case #iii

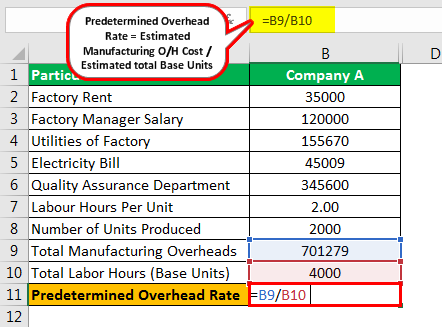

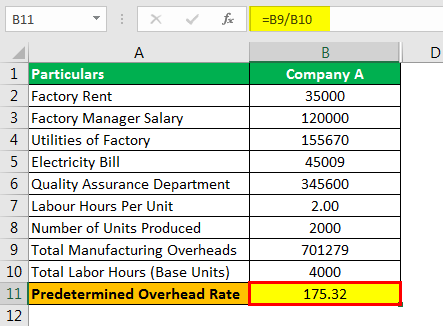

Visitor X and Company Y are competing to acquire a massive order equally that volition make them much recognized in the market, and also, the project is lucrative for both of them. After going to its terms and conditions of the bidding, it stated the bid would exist based on the overhead rate percentage. Therefore, the ane with the lower shall be awarded the auction winner since this projection would involve more than overheads. Both of the companies have reported the post-obit overheads.

| Particular | Visitor A | Company B |

|---|---|---|

| Factory Hire | 35000 | 38500 |

| Factory Manager Salary | 120000 | 115000 |

| Utilities of Factory | 155670 | 145678 |

| Electricity Neb | 45009 | 51340 |

| Quality Assurance Department | 345600 | 351750 |

| Labour Hours per Unit of measurement | two hrs | one.5 hrs |

| Number of Units Produced | 2000 | 2500 |

You lot must summate the predetermined overhead charge per unit based on the above information and determine the chances of which visitor is more?

Solution:

We shall first calculate the total manufacturing overhead cost for Company A

=35000+120000+155670+45009+345600

- Total Manufacturing Overheads = 701279

Total Labor Hours will exist –

=2000*two

- Total Labor Hours =4000

Calculation of Predetermined Overhead Charge per unit for Company A is as follows

=701279/4000

The predetermined Overhead Rate for Company A will be –

Predetermined Overhead Rate = 175.32

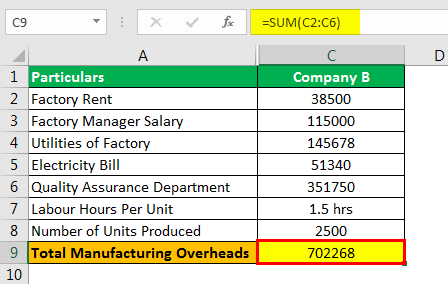

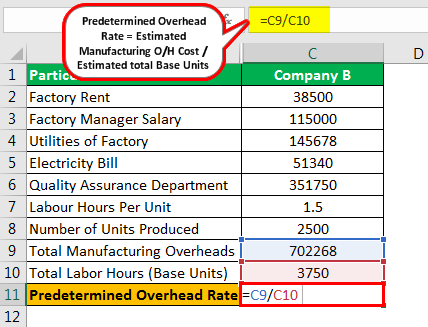

We shall starting time summate the total manufacturing overhead toll for Company B

=38500 + 115000 + 145678 + 51340 + 351750

- Total Manufacturing Overheads = 702268

Total Labor Hours will be –

=2500*1.5

- Total Labor Hours =3750

Calculation of Predetermined Overhead Rate for Company B is every bit follows

=702268/3750

The predetermined Overhead Rate for Company B will be –

Predetermined Overhead Charge per unit = 187.27

Hence, preliminary, visitor A could be the winner of the auction even though the labor 60 minutes used by company B is less, and units produced more only considering its overhead rate is more than that of visitor A.

Relevance and Uses

Commonly, the manufacturing overhead toll for machine hours tin can be ascertained from the predetermined overhead rate in the manufacturing industry. All the same, in the case of machine production, this rate can exist used to place the expected costs, which shall permit the firm to allocate their financial resource properly, which are needed to ensure the efficient and proper working of operations and production. Further, it is stated that the reason for the same is that overhead is based on estimations and not the actuals.

Recommended Manufactures

This article has been a guide to the Predetermined Overhead Charge per unit Formula. Here we talk over the adding of the predetermined overhead rate using its formula and downloadable excel template. Yous tin acquire more than well-nigh accounting from the following manufactures –

- Calculate Absorption Costing

- Formula of Overhead Ratio The overhead ratio is the ratio of operating expenses to the operating income, giving details about the percentage of fixed costs involved in generating a specific operating income for a visitor. A lower overhead ratio ways that a higher proportion of expenses are related to direct product costs. read more

- Activeness-Based Costing Formula Activity based costing (also known as ABC costing) refers to the allotment of price (charges and expenses) to different heads or activities or divisions according to their actual use or on business relationship of some basis for allocation i.e. (price commuter charge per unit which is calculated past total price divided by total no. of activities) to arrive at a profit. read more

- Stock-still Toll Calculation Fixed Cost refers to the cost or expense that is non affected by any decrease or increase in the number of units produced or sold over a short-term horizon. It is the type of cost which is not dependent on the business organization activity. read more than

- Advantages of Cost Accounting The advantages of cost accounting include: Cost classification, Toll control and reduction, Eliminates wasteful activities, Ensures appropriate pricing of products or services, Enhances the overall organizational profitability, Supports managerial decision making, Allows fixation of accountability and responsibility, Benefits the whole economic system. read more

A Predetermined Overhead Application Rate,

Source: https://www.wallstreetmojo.com/predetermined-overhead-rate-formula/

Posted by: gogginsmakeles.blogspot.com

0 Response to "A Predetermined Overhead Application Rate"

Post a Comment